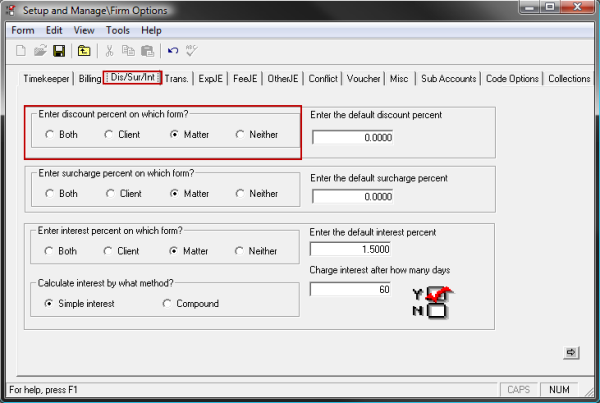

Discount/Surcharge/Interest tab

Note

Remember to click the 'Save' icon to commit the changes.

Enter discount percent on which form?

May be set to Both, Client, Matter or Neither. In all cases, the discount percent values will default to the amounts entered on the Disc/Sur/Int tab in Firm Options.

- When set to Both, the percentage may be changed at the Client or Matter level.

- When set to Client, the percentage may be changed at the Client level. The value entered on the Client will be used as the default for all Matters for that Client.

- When set to Matter, the system will allow the percentage to be changed on the individual Matters.

- When set to Neither, the system will not allow the discount percentage to be changed.

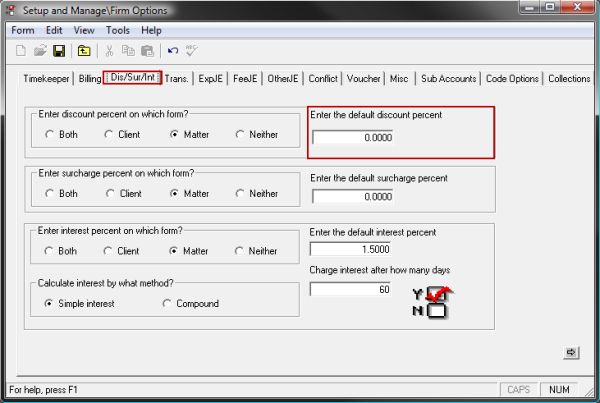

Enter the default discount percent.

The amount entered here is used as the default discount percentage.

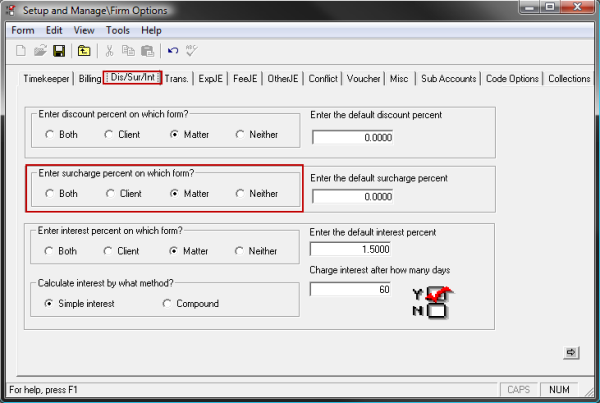

Enter surcharge percent on which form?

May be set to Both, Client, Matter or Neither. In all cases, the surcharge percent values will default to the amounts entered on the Disc/Sur/Int tab in Firm Options.

- When set to Both, the percentage may be changed at the Client or Matter level.

- When set to Client, the percentage may be changed at the Client level. The value entered on the Client will be used as the default for all Matters for that Client.

- When set to Matter, the system will allow the percentage to be changed on the individual Matters.

- When set to Neither, the system will not allow the surcharge percentage to be changed.

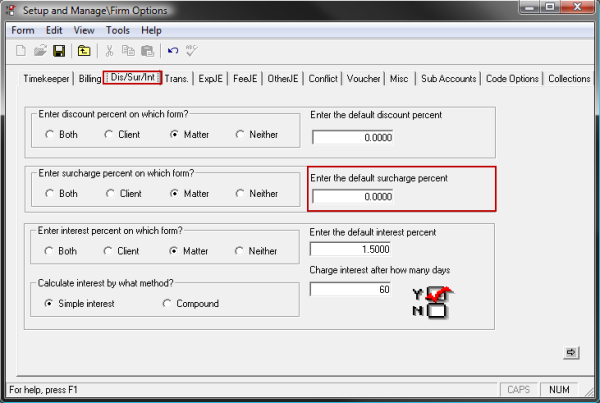

Enter the default surcharge percent.

The amount entered here is used as the default surcharge percentage.

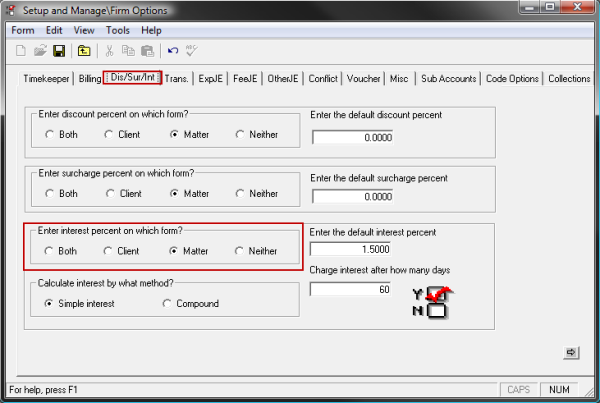

Enter interest percent on which form?

May be set to Both, Client, Matter or Neither. In all cases, the interest percent values will default to the amounts entered on the Dis/Sur/Int tab in Firm Options.

- When set to Both, the percentage may be changed at the Client or Matter level.

- When set to Client, the percentage may be changed at the Client level. The value entered on the Client will be used as the default for all Matters for that Client.

- When set to Matter, the system will allow the percentage to be changed on the individual Matters.

- When set to Neither, the system will not allow the interest percentage to be changed.

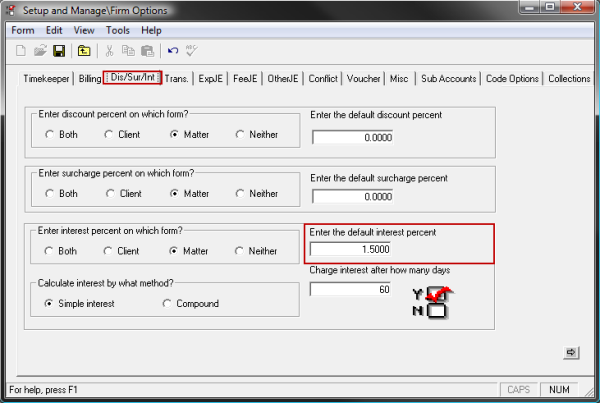

Enter the default interest percent.

The amount entered here will be used as the default interest percentage. The total annual percentage to be charged must be divided by the billing frequency to determine the interest percent. Majority rules should be used to determine the default interest percentage. See Interest Calculation details below.

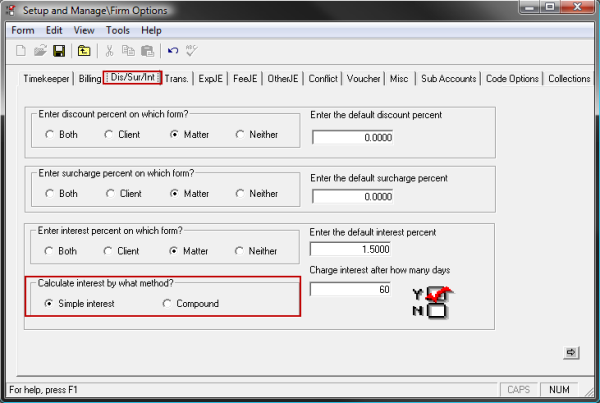

Calculate interest by what method?

May be set to Simple Interest or Compound.

- Simple Interest = Amount Billed x Interest Percent

- Compound Interest = (Amount Billed + Interest Accrued on Past Due Balance) x Interest Percent

Time is not included in the interest calculations as time is determined by the billing frequency. The total annual percentage to be charged should be divided by the billing frequency to determine the interest percent.

Example: If a firm typically uses a billing frequency of Monthly, and they wish to charge 18% interest per year, the actual percentage to be used in Juris should be entered as 1.5%. A firm that wishes to charge 15% interest per year and typically uses a quarterly billing frequency, should enter 3.75% as the default interest percentage.

The default percentage entered in Firm Options should be selected based on the majority rules or typical scenarios in the firm's billing system. The percentage may be changed on individual clients or matters when they use a billing frequency that is not the typical billing frequency used by the firm.

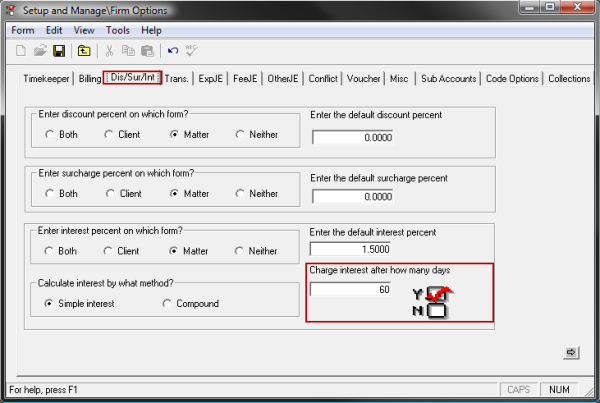

Charge interest after how many days.

The grace period for interest would be entered here. Most firms charging interest will give clients a minimum of 30 days to make payment before interest begins to accrue on outstanding balances. This value may be set to any number of days as defined by the firm's typical billing agreement.